By MEI News Analysis Team, 19 May 2025

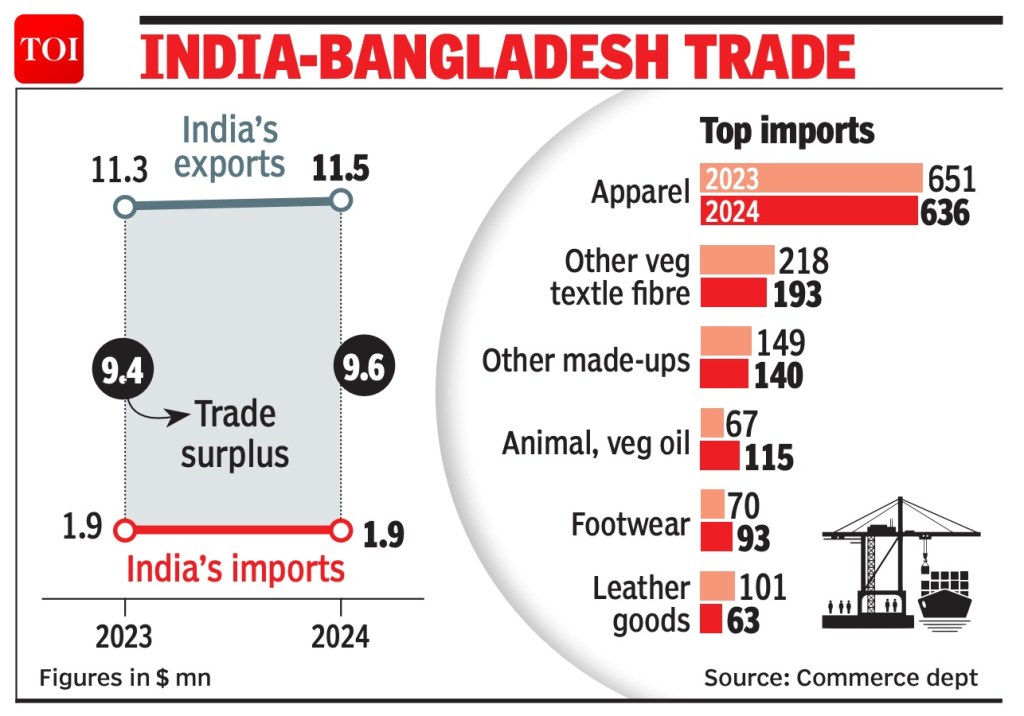

India’s recent restrictions on Bangladeshi imports and transshipment facilities have sent shockwaves through bilateral trade, escalating tensions between the two South Asian neighbors.

The measures, which include barring key Bangladeshi exports like ready-made garments (RMG) from land ports and limiting them to two seaports, mark a significant shift in a once-robust trade relationship. This analysis explores the impact on Bangladesh, the rationale behind the decision, and the geopolitical and economic factors driving India’s actions.

A Blow to Bangladesh’s Export Economy

Bangladesh’s economy, heavily reliant on its garment industry, faces significant disruption from India’s port restrictions.

In 2023, Bangladesh exported $38 billion in RMG globally, with $700 million directed to India, 93% of which entered through land ports.

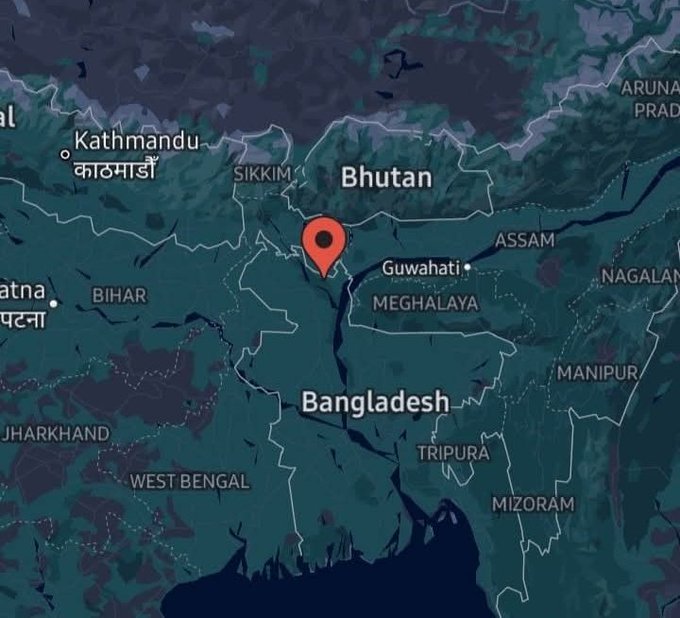

The new rules, effective from 17 May 2025, restrict RMG and other goods like processed foods, plastics, and wooden furniture to only Nhava Sheva and Kolkata seaports, banning land port access in Assam, Meghalaya, Tripura, Mizoram, and specific West Bengal checkpoints.

The impact is immediate.

A former director of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) warned that longer shipping routes via seaports will increase costs and delays, potentially reducing export competitiveness.

The restrictions could affect $770 million in Bangladeshi exports to India—42% of its global export earnings. With 4,000 garment factories employing millions, the sector is already strained, with 170 factories closing post-2024 political upheaval, leaving 100,000 workers jobless.

The earlier withdrawal of India’s transshipment facility on 8 April 2025 further complicates matters.

Since 2020, Bangladesh used Indian ports and airports to ship 35,000 tonnes of garments worth $0.5 billion to 36 countries. The termination, citing congestion, forces Bangladeshi exporters to rely on limited domestic infrastructure like Chittagong and Dhaka airports, which lack capacity for heavy cargo. This could disrupt global supply chains for brands like Zara, which rely on Delhi’s air freight hub.

Bangladesh’s interim government, led by Muhammad Yunus, expressed cautious optimism, planning to address the issue through dialogue. However, exporters fear that these “non-tariff barriers” could erode their edge in a competitive global market, especially amidst U.S. tariffs and domestic factory closures.

Why India Took This Step

India’s Ministry of External Affairs (MEA) justified the measures as a response to congestion at ports and airports caused by Bangladeshi cargo.

The Apparel Export Promotion Council (AEPC) had lobbied for the transshipment ban, citing inflated cargo rates and logistical delays. However, the timing and scope of the restrictions suggest deeper geopolitical and economic motives.

Tit-for-Tat Trade Measures

India’s actions follow Bangladesh’s own trade restrictions.

In March 2025, Dhaka halted Indian yarn imports through land ports, favoring sea routes, and closed three land ports (Chilahati, Daulatganj, Tegamukh) while suspending another (Balla). Indian officials viewed these as “regressive” and unilateral, with one source alleging Dhaka aimed to boost imports from Pakistan.

Bangladesh also established an Investigation, Research, and Management Unit (IRM) at Benapole port, increasing scrutiny on Indian goods, which India saw as a trade barrier.

Government sources emphasized “reciprocal terms” in trade, arguing that Bangladesh cannot “cherry-pick” benefits while restricting Indian exports, particularly in the Northeast.

Indian yarn and rice faced barriers, and Dhaka’s high transit charges limited Northeastern states’ access to Bangladeshi markets. The port curbs, thus, aim to level the playing field, protecting Indian apparel exporters who compete with Bangladesh’s duty-free access under the South Asian Free Trade Agreement (SAFTA).

Geopolitical Tensions

The clampdown coincides with deteriorating India-Bangladesh relations since the ouster of Sheikh Hasina’s government in August 2024.

Hasina’s pro-India stance contrasted with the interim Yunus administration’s pivot toward China and Pakistan. Yunus’s remarks in Beijing, describing Bangladesh as the “guardian of the ocean” and proposing Chinese trade routes via Bangladeshi ports for India’s Northeast, sparked outrage.

India’s concerns extend to Bangladesh’s inability to curb attacks on Hindu minorities post-Hasina, with reports of social and economic boycotts fueling New Delhi’s frustration.

Dhaka’s extradition plea for Hasina, sheltered in India, and its warming ties with Pakistan further strained relations. The port restrictions, thus, signal India’s intent to recalibrate a relationship it perceives as increasingly one-sided.

Strategic Maritime Competition

India’s moves also reflect a broader contest with China in the Bay of Bengal. Bangladesh’s participation in China’s Belt and Road Initiative (BRI) since 2016, including a $2.1 billion investment commitment, has raised India’s guard.

While India secured operational rights to Mongla port in 2024, outbidding China, Yunus’s push for a Chinese industrial zone in Chittagong heightened tensions. The port curbs may pressure Bangladesh to balance its alignments, reinforcing India’s regional influence.

Regional and Economic Fallout

The restrictions impact more than bilateral trade.

In West Bengal, 20-30 trucks daily carried premium Bangladeshi garments via Petrapole, supporting local truckers and workers. The ban could reduce employment and transport revenue, though Indian officials prioritize “national interest” over regional losses. Indian retailers, reliant on low-cost Bangladeshi garments, may face supply chain disruptions, potentially passing costs to consumers.

Regionally, the curbs align with India’s Northeast development goals. By limiting Bangladesh’s duty-free access, India aims to boost local manufacturing under the Atmanirbhar Bharat initiative. However, the Northeast’s economic isolation persists, as Bangladesh’s port closures limit India’s access to Chittagong and Mongla for trade with Nepal and Bhutan.

A Path Forward?

Bangladesh’s commerce adviser, SK Bashir Uddin, called for dialogue, but the interim government’s lack of formal notification on India’s restrictions suggests communication gaps. Indian officials remain open to resolving trade issues but insist on reciprocity.

The BIMSTEC framework, emphasized by Prime Minister Narendra Modi, could offer a platform for dialogue, but political will is key.

The port clampdown reveals the fragility of India-Bangladesh ties, once a model of South Asian cooperation.

With $12.9 billion in trade at stake, both nations face a choice: escalate a trade war or rebuild trust.

For Bangladesh, the economic cost is immediate; for India, the challenge is balancing strategic assertiveness with regional stability.

Leave a comment