By Dr. Shubhda Chaudhary, MEI News

20 May 2025

Yemen’s Houthi rebels have announced a “naval blockade” targeting Israel’s Haifa port, a critical hub for the country’s imports and exports, in response to Israel’s ongoing bombardment of Gaza.

Meanwhile, across Haifa Bay, China’s state-owned Shanghai International Port Group (SIPG) manages the newer Haifa Bayport, raising complex security and geopolitical concerns.

The Houthi threat, combined with China’s strategic presence, places Haifa at the centre of a volatile mix of economic, military, and diplomatic challenges.

What does this mean for Israel’s maritime trade, the Adani Group, and the regional balance of power?

Haifa’s Dual Ports: Adani and China

Haifa, Israel’s largest port city, hosts two major facilities:

- The privatised Haifa Port, acquired in January 2023 by a consortium led by Adani Ports and Special Economic Zone (APSEZ) and Israel’s Gadot Group for $1.18 billion

- The newer Haifa Bayport, operated by SIPG under a 25-year concession since 2021.

Haifa Port, handling a significant share of Israel’s imports and exports, is a cornerstone of the country’s economy, facilitating trade in energy, consumer goods, and industrial materials. Haifa Bayport, located just 1.8 km from Israel’s main naval base, enhances the city’s capacity but has sparked concerns about Chinese access to sensitive infrastructure.

The Adani acquisition was a strategic coup, outbidding Chinese and Turkish competitors, and was hailed by Israeli Prime Minister Benjamin Netanyahu as an “enormous milestone” for India-Israel connectivity. It aligns with India’s ambition to establish a trans-Mediterranean trade route bypassing the Suez Canal, cutting shipping times from Mumbai to Europe by up to 40%.

Conversely, SIPG’s Bayport has raised alarms in Israel and the US, particularly due to its proximity to a naval base housing Israel’s nuclear submarines. Critics, including Ashdod Port chairman Shaul Schneider, argue that SIPG’s operations could enable Chinese espionage or sabotage, given Beijing’s ties to Iran, a key Houthi backer.

The Houthi Threat: A Distant but Disruptive Force

Haifa port, Israel’s largest seaport, handles a significant portion of the country’s maritime trade, including energy, consumer goods, and industrial materials.

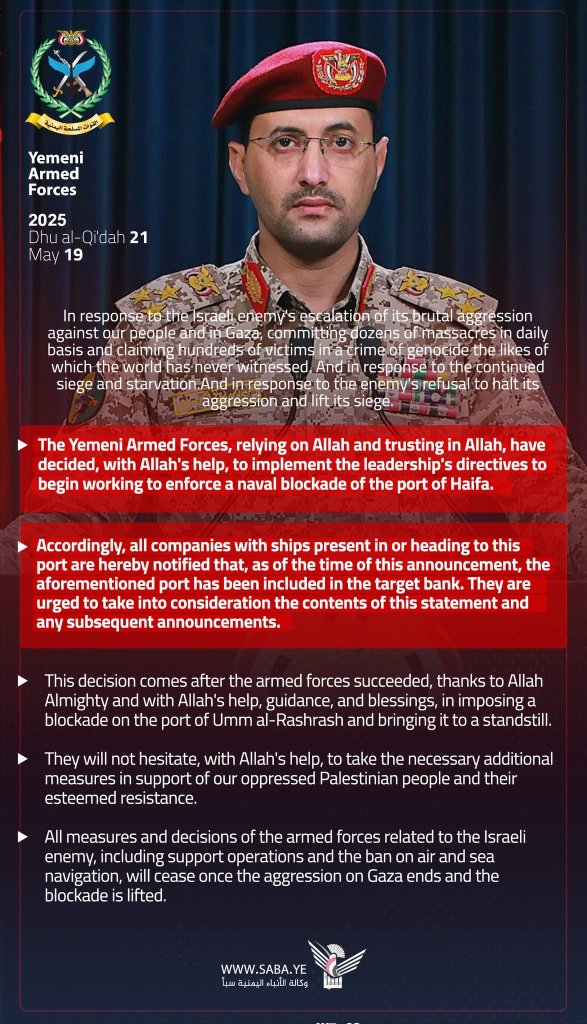

On 19 May 2025, Houthi spokesman announced a “maritime blockade” targeting ships serving Haifa Port, citing Israel’s actions in Gaza as the trigger.

While the Houthis lack the naval capacity to enforce a direct blockade in the Mediterranean, their control over Yemen’s Red Sea coast enables them to target vessels transiting the Bab al-Mandab Strait, a critical chokepoint for ships en route to Haifa via the Suez Canal.

Despite a US-led bombing campaign in March and April 2025, costing $200 million, the Houthis retain a “meaningful capability” to deploy missiles, drones, and unmanned surface vessels (USVs), some of which are of Chinese or Iranian origin.

The group’s past attacks, including a July 2024 drone strike on Haifa Port and the sinking of the MV Tutor, demonstrate their ability to disrupt shipping. While Haifa Port has not yet reported significant damage, the threat of Houthi attacks has already driven up war risk insurance premiums, now reaching 2% of a vessel’s value for Red Sea transits, compared to 1% in August 2024. Shipping companies may opt for longer routes around the Cape of Good Hope, increasing costs and transit times, which could erode Haifa Port’s competitiveness.

Haifa Bayport, operated by SIPG, is not explicitly targeted by the Houthis, possibly due to China’s neutral stance in the Israel-Gaza conflict and its economic ties with Iran. However, Chinese shipping giant COSCO, a partner in Haifa, has faced profit losses. These claims remain unverified, but they highlight the broader economic ripple effects of Houthi actions on all Haifa-based operations.

Economic and Operational Impacts

For Adani, the Houthi threat poses significant risks to its $1.18 billion investment in Haifa Port. The port contributes about 3% of Adani Ports’ total cargo volume, but its strategic value lies in its role as a gateway for India-Israel trade.

A sustained Houthi campaign could deter shipping lines like Maersk or MSC, reducing port traffic and revenue. Increased insurance costs and rerouting could also raise freight rates, impacting Israel’s import-dependent economy. Adani has pledged to “transform the port landscape,” with plans for infrastructure upgrades and an AI lab in Tel Aviv, but these ambitions may be tested by ongoing insecurity.

Haifa Bayport, under SIPG, faces different challenges.

Its proximity to Israel’s naval base has drawn scrutiny, with US officials, including former CIA Director William Burns, warning of espionage risks since 2021. A recent Israeli-approved expansion of Bayport, granting SIPG two additional cargo quays, has intensified concerns. Critics argue that SIPG’s access to port systems could expose sensitive data, potentially benefiting Iran or the Houthis.

Israel’s other ports, Ashdod and Eilat, are not currently targeted by the Houthis, but Eilat has already been crippled, declaring bankruptcy in July 2024 after an 85% drop in operations due to Red Sea attacks. This shifts pressure onto Haifa and Ashdod, which are also preparing for potential escalation with Hezbollah in Lebanon. A dual-port disruption in Haifa could severely strain Israel’s trade, which relies on maritime routes for 99% of goods.

Geopolitical Complexities

The Houthi blockade threat is rooted in the broader Israel-Gaza conflict, with the group demanding an end to Israel’s Gaza operations.

As part of Iran’s “Axis of Resistance,” the Houthis have leveraged their Red Sea campaign to gain regional influence, recruiting thousands of fighters and enhancing their domestic and Arab-world standing.

Their actions complicate the US-Houthi ceasefire, brokered by Oman in May 2025, which excludes Israel, leaving Haifa vulnerable. Israel’s vow to respond “sevenfold” to Houthi aggression, coupled with strikes like the 6 May 2025 attack on Sanaa’s airport, risks further escalation.

China’s role adds another layer of complexity.

Beijing’s economic ties with Iran and its backing of the Palestinian cause have raised suspicions in Israel and the US, with some alleging that Chinese components in Houthi weaponry indirectly fuel the conflict.

Haifa Bayport transits 90% of Israel’s food imports, suggesting a critical role, though these claims lack corroboration. Israel’s decision to expand SIPG’s operations, despite US pressure to limit Chinese involvement, reflects a delicate balance between economic needs and security concerns.

For Adani, the Houthi threat intersects with India’s strategic rivalry with China.

The acquisition of Haifa Port was seen as a counter to China’s Belt and Road Initiative, aligning with the US-backed I2U2 framework (India, Israel, UAE, US). However, operating alongside SIPG in Haifa places Adani in a precarious position, navigating both Houthi threats and geopolitical tensions.

Looking Ahead

The Houthi blockade threat tests Haifa Port’s resilience and Adani’s ability to manage risks in a conflict zone.

Israel’s multilayered defences, including the Iron Dome, may mitigate direct attacks, but the economic impact of rerouting and higher costs could challenge Adani’s long-term plans. Haifa Bayport, while not directly targeted, faces scrutiny over China’s strategic foothold, with potential implications for Israel’s security and US relations.

A Gaza ceasefire could theoretically reduce Houthi attacks, but their entrenched capabilities and political leverage suggest a persistent threat.

For Adani, coordination with Israeli authorities and contingency plans, such as enhanced security or alternative routing, will be critical. For SIPG, maintaining operations amid regional tensions requires balancing China’s neutral stance with Israel’s security demands.

As Haifa navigates these dual challenges, its role as a trade hub hangs in the balance, with implications for Israel, India, China, and the global maritime economy.

This analysis draws on recent statements from Houthi officials, Israeli authorities, and industry sources, and does not endorse any party’s actions.

Leave a comment