The recent public fallout between US President Donald Trump and tech billionaire Elon Musk, once close allies, has sent shockwaves through global markets and politics.

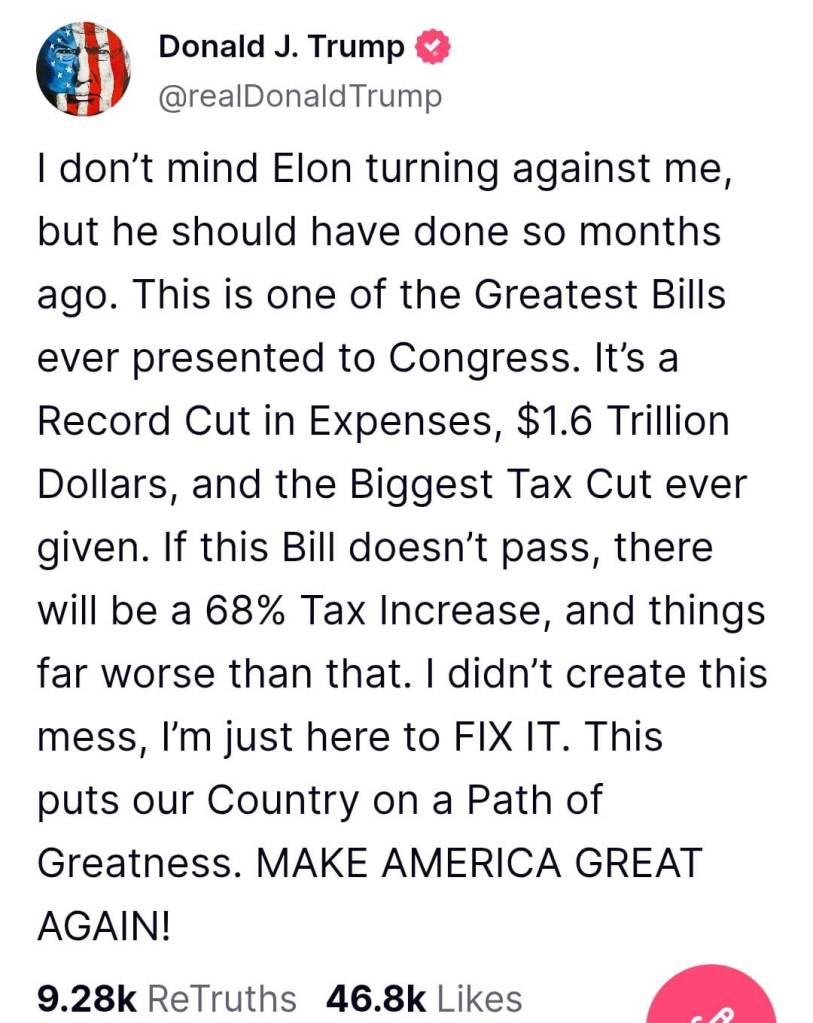

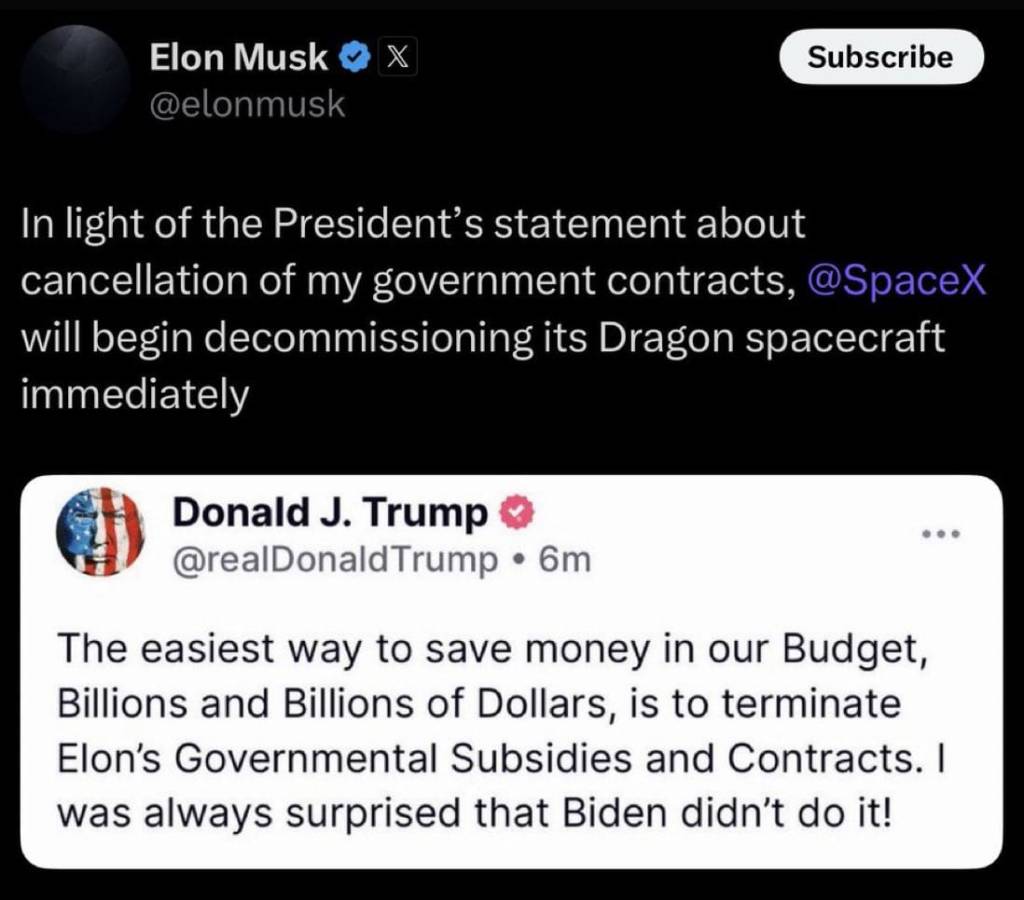

Their feud, erupting in early June 2025, stems from disagreements over a sweeping US tax-and-spending bill, with Musk denouncing it as a “disgusting abomination” and Trump threatening to sever government contracts with Musk’s companies, including Tesla and SpaceX.

For India, a nation poised to deepen ties with both Musk’s ventures and the US under Trump’s administration, this rift presents a complex diplomatic and economic challenge.

This analysis explores how India can navigate this split, weighing economic opportunities, geopolitical risks, and domestic priorities.

Economic Opportunities

India is poised to benefit from Elon Musk’s ventures.

Starlink, with regulatory approval, aims to provide satellite internet to rural areas, potentially transforming connectivity.

Tesla, while not pursuing manufacturing, is exploring showrooms, which could boost India’s electric vehicle (EV) market. However, Trump’s threats to cut Musk’s government contracts could destabilize these plans, affecting investment timelines and financial stability.

Economic Angle: Balancing Tesla and Starlink Opportunities

India stands at a critical juncture with Musk’s companies.

Starlink, Musk’s satellite internet venture, has secured a letter of intent from the Indian government to provide services, aiming to bridge connectivity gaps in rural areas (TechCrunch).

With partnerships with local telecom giants like Airtel and Jio, Starlink could position India as one of its largest markets, potentially serving 30,000 to 50,000 users initially with plans to scale up significantly by 2027 (Outlook Business).

Meanwhile, Tesla’s plans have shifted: Union Heavy Industries Minister H D Kumaraswamy noted in early June 2025 that Tesla is not pursuing manufacturing but is exploring retail showrooms, a move that could still boost India’s EV ecosystem (Electrek).

Challenges

- Market Volatility: The feud has already impacted markets, with Tesla’s stock plummeting 14% on 5 June 2025, wiping out $150 billion in market value (Reuters). This volatility could deter investors and delay Tesla’s showroom plans or Starlink’s rollout.

- EV Market Fit: Tesla’s high-cost vehicles may struggle in India’s price-sensitive market, where EV adoption is nascent and charging infrastructure is limited. The potential loss of US EV tax credits, part of Trump’s bill, could further increase costs, reducing Tesla’s appeal (The New York Times).

- Regulatory Hurdles: Starlink awaits spectrum allocation and additional approvals, complicated by national security concerns and resistance from local telecom providers wary of competition (India TV).

Strategic Recommendations

India should adopt a cautious, incentive-driven approach.

Offering tax breaks or land subsidies for Tesla showrooms could encourage investment without overcommitting resources.

For Starlink, expediting regulatory approvals while enforcing strict data security protocols would balance growth with sovereignty concerns. Diversifying partnerships with other global EV and satellite tech firms, such as European or Japanese companies, would mitigate risks tied to Musk’s ventures.

| Economic Aspect | Opportunity | Challenge | Recommendation |

|---|---|---|---|

| Tesla Showrooms | Boosts EV ecosystem | High costs, limited market fit | Offer tax incentives, monitor market response |

| Starlink Launch | Rural connectivity | Regulatory delays, local competition | Expedite approvals, enforce data security |

| Market Stability | Attract FDI | Volatility from feud | Diversify tech partnerships |

Geopolitical Angle: Navigating US-India Relations

The Trump-Musk split coincides with a delicate phase in US-India relations.

Trump, re-elected in November 2024, has pushed aggressive trade policies, including tariffs that could target India (The Indian Express).

His “America First” agenda contrasts with Musk’s globalist ventures, which India has courted to bolster its tech and infrastructure ambitions.

The rift raises questions about whether India can leverage Musk’s companies to strengthen ties with Trump or if aligning with Musk risks straining relations with Washington.

Challenges

- Trade Tensions: Trump’s tariff threats could escalate if India is perceived as favoring Musk, potentially affecting exports like pharmaceuticals and textiles (Business Insider). Trump has already criticized India’s high EV import duties, complicating Tesla’s entry.

- Diplomatic Tightrope: India’s history of mediating global disputes, such as past Trump-brokered India-Pakistan ceasefires, could be tested. Aligning too closely with Musk might alienate Trump, while siding with the US could jeopardize Starlink and Tesla deals.

- Global Perception: The feud’s public nature, amplified by social media memes and international commentary (e.g., Russian official Dmitry Medvedev’s humorous offer to mediate for Starlink shares), could undermine India’s image as a stable investment hub (The New York Times).

Strategic Recommendations

India must prioritize quiet diplomacy, engaging White House aides to clarify US priorities without directly confronting Trump.

Strengthening the Quad alliance (US, India, Japan, Australia) would reinforce strategic ties, offsetting potential friction. India could also leverage the feud to negotiate better terms with Musk’s companies, capitalizing on their need for global markets amidst US uncertainty.

Domestic Angle: Prioritizing India’s Interests

At home, India faces pressure to deliver on its Digital India and green energy goals.

Starlink’s satellite internet aligns with connecting remote regions, while Tesla’s showrooms could support sustainable transport. However, the Musk-Trump feud introduces risks that could clash with domestic priorities like job creation and affordable technology.

Challenges

- Public Sentiment: Indian netizens have engaged with the feud on X, with some humorously suggesting Prime Minister Narendra Modi mediate (The New York Times). This reflects public awareness but also pressure to act decisively.

- Local Industry Impact: Starlink’s entry threatens telecom giants like Jio and Airtel, who fear market disruption (Light Reading). Tesla’s premium focus may do little for mass-market EV adoption, frustrating goals to reduce emissions and oil imports.

- Economic Fallout: Tesla’s $150 billion market value loss and broader market jitters (Nasdaq dropped 0.8% on 5 June 2025) signal volatility that could affect India’s tech and auto sectors (Reuters).

Strategic Recommendations

India should focus on self-reliance, supporting domestic EV makers like Tata Motors and Mahindra to hedge against Tesla’s uncertainty. For Starlink, pilot projects in rural areas with local partnerships would test viability while boosting Indian tech firms. Transparent public communication, highlighting benefits and addressing concerns, will manage expectations and maintain support.

| Domestic Aspect | Opportunity | Challenge | Recommendation |

|---|---|---|---|

| Digital India | Starlink connectivity | Telecom competition | Pilot projects, local partnerships |

| EV Adoption | Tesla brand influence | Premium pricing | Support domestic EV makers |

| Public Support | Tech enthusiasm | Sovereignty concerns | Transparent communication |

Broader Implications: Global Ripple Effects

The Musk-Trump split has global repercussions, affecting NASA’s reliance on SpaceX for missions like the International Space Station (ISS), where India’s astronaut Shubhanshu Shukla participated in Axiom-4 (The New York Times).

A prolonged feud could chill foreign direct investment and disrupt global tech innovation, impacting India’s ambitions in space and technology.

Challenges

- Market Volatility: Tesla’s stock crash and Nasdaq’s decline reflect investor fears that could spill into India’s markets (Reuters).

- Space Cooperation: Trump’s review of SpaceX contracts could disrupt NASA missions, indirectly affecting India’s space program.

- Ideological Divide: Musk’s centrist, globalist stance versus Trump’s nationalist agenda highlights a broader clash, complicating India’s alignment (Bloomberg).

Strategic Recommendations

India should diversify space and tech partnerships, engaging with European and Japanese firms to reduce reliance on SpaceX.

Monitoring the feud’s trajectory via open-source data, such as X posts, will inform timely policy adjustments. India could also position itself as a neutral tech hub, attracting investment from multiple global players.

Conclusion

The Musk-Trump split presents India with a complex challenge, requiring a delicate balance between economic opportunities and geopolitical realities.

Economically, India must court Tesla and Starlink cautiously, offering incentives while diversifying partnerships. Geopolitically, quiet diplomacy and a strengthened Quad alliance will preserve US ties.

Domestically, supporting local industries and engaging the public will align with national priorities.

By adopting a pragmatic, multi-pronged approach, India can turn this billionaire battle into an opportunity to advance its technological and strategic goals.

Leave a comment